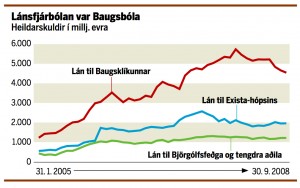

The Icelandic Parliament’s Special Investigation Commission, SIC, on the 2008 bank collapse correctly identified two factors contributing to the collapse: the rapid expansion of the banks on the one hand and a hidden, or invisible, risk factor embedded in the banking sector on the other hand, consisting of cross-ownership and overestimated equity of the banks’ biggest debtors who also happened to be their chief owners. However, the data presented by the SIC shows that the Baugur Group was in a class of its own in this respect. These were some of the conclusions which Professor Hannes H. Gissurarson presented at a conference on research in the social sciences, held by the Institute for Social Science Research at the University of Iceland, Friday 31 October 2014. Professor Gissurarson submitted that the SIC had not adequately investigated foreign factors in the collapse. The SIC had described a vulnerable situation, more or less correctly. But a downturn need not always become a total collapse. Decisions made abroad had entered this vulnerable situation and become crucial to a collapse: the decision of the US Federal Reserve System not to make dollar swap deals with the Central Bank of Iceland, while it made such deals with all other Western European central banks; the decision of the British Labour government to deny help to British banks owned by Icelanders at the same time as it offered an immense rescue package to all other British banks; and the decision of the Labour government to impose an anti-terrorism law on Icelandic banks and government institutions, for a while, which made impossible all attempts to reorganise the banking sector on lines of what had been done in the Swedish financial crisis of 1991–2.

It was interesting, Professor Gissurarson said, to read the account of the international financial crisis by Alistair Darling, then British Chancellor of the Exchequer, Back from the Brink, published in 2011. Iceland was mentioned there several times, but invariably with hostility. Darling suggested for example, incorrectly, that Icelandic representatives were travelling in jumbo jets (Boeing 747) around the world and that Icelandic financiers had become substantial donors to the Conservative Party. Moreover, his descriptions of conversations with Icelandic leaders, including Minister of Business Affairs Bjorgvin G. Sigurdsson, Prime Minister Geir H. Haarde and Finance Minister Arni Mathiesen, were less than accurate. Darling claimed that these men had kept information hidden from him, or that they had not known themselves what was happening in the Icelandic banks. But Darling himself had not had a clue as to what was happening in the Scottish banks at the time, RBS, Royal Bank of Scotland, and HBOS, Halifax Bank of Scotland, both of which had to rescued with gigantic sums. Professor Gissurarson pointed out that already in 2009, the Treasury Committee of the House of Commons had concluded that Darling had not been wholly truthful in his public accounts of the conversation with Finance Minister Mathiesen, shortly before he imposed the anti-terrorism law on Iceland, so, unsurprisingly, in the book Back from the Brink, he offered another account of the conversation (which had been taped unbeknownst to Mr. Darling).

Professor Gissurarson said that Darling’s obvious hostility towards Iceland had to be explained. It was possible that he simply thought that the Icelandic banks had recklessly overexpanded. But the same applied to the Scottish banks which had become very big in proportion to Scotland’s GDP, in fact relatively bigger than the Icelandic banks. Another explanation could be that the lean and mean Icelandic banks were, with their offers of high interest on online accounts, luring customers away from more traditional “High Street” British banks, thus incurring their hostility. A third explanation was that Darling had wanted to demonstrate to the Scottish nation that a country could hardly survive on its own, without help from others. After all, Darling was the leader of the Scottish movement against independence. Professor Gissurarson’s lecture formed a part of the joint project by RNH and AECR, Alliance of European Conservatives and Reformists, on “Europe, Iceland and the Future of Capitalism”.

Professor Gissurarson said that Darling’s obvious hostility towards Iceland had to be explained. It was possible that he simply thought that the Icelandic banks had recklessly overexpanded. But the same applied to the Scottish banks which had become very big in proportion to Scotland’s GDP, in fact relatively bigger than the Icelandic banks. Another explanation could be that the lean and mean Icelandic banks were, with their offers of high interest on online accounts, luring customers away from more traditional “High Street” British banks, thus incurring their hostility. A third explanation was that Darling had wanted to demonstrate to the Scottish nation that a country could hardly survive on its own, without help from others. After all, Darling was the leader of the Scottish movement against independence. Professor Gissurarson’s lecture formed a part of the joint project by RNH and AECR, Alliance of European Conservatives and Reformists, on “Europe, Iceland and the Future of Capitalism”.