Professor Hannes H. Gissurarson, RNH’s Academic Director, gives a series of lectures in 2014 on various subjects related to RNH’s research projects.

1. At the spring conference of the Institute of Business Affairs at the University of Iceland Friday 14 March 2014 he discusses business ethics in the context of the sale of assets belonging to the Icelandic banks after their 2008 collapse, with Dr. Ingjaldur Hannibalsson in the chair. First, Professor Gissurarson briefly sets out the views of St. Thomas Aquinas on business ethics. While Aquinas certainly recognised a merchant’s right to accept the offer of the highest bidder (Summa Theologiæ, II, II, 77, 3), he also taught that a person should not use a temporary emergency situation to exert a higher price from his neighbours for his good than would be fair and conventional in more usual circumstances (Summa Theologiæ, II, II, 66, 7) . Such a trade would not be just. Professor Gissurarson then analyses three examples of “fire sales” of assets belonging to the Icelandic banks abroad, all from sales of assets belonging to Glitnir Bank in the Nordic countries. He asks whether these sales were unjust in the sense of Aquinas and also of modern libertarians such as Friedrich A. von Hayek and Robert Nozicks (as seen in their famous discussions of the only spring in the oasis). Professor Gissurarson tries to make an estimate of the loss from the “fire sale” in these three examples, only a part of the overall loss resulting from the bank collapse. Professor Gissurarson’s lecture forms a part of the joint RNH-AECR research project on “Europe, Iceland, and the Future of Capitalism”.

2. At the 3rd annual European Students for Liberty Conference, at Humboldt University in Berlin 14–16 March 2014, Professor Gissurarson gives a lecture on the foreign factors in the 2008 collapse of the Icelandic banks, the government responses to it and the lessons other European nations can draw from them. His lecture is scheduled at 13.40–14.15 Saturday 15 March. Many well-known writers, scholars and commentators on current affairs talk at the conference, including Swedish historian Johan Norberg, Dr. Tom Palmer from the Atlas Foundation and Dr. Daniel Mitchell from the Cato Institute, both in Washington DC, the US, Professor Kewin Dowd from England, Dr. Karen Horn, a former business editor at Frankfurter Allgemeine Zeitung, who lectures at Humboldt University, Professor Charles Blankart, Humboldt University, Professor Ilya Somin, George Mason University, Virginia, the US, Dr. Alberto Mingardi, Bruno Leoni Institute, Italy, and Matthew Sinclair, Executive Director of the British Taxpayers’ Union. Professor Gissurarson’s lecture forms a part of the joint RNH-AECR research project on “Europe, Iceland, and the Future of Capitalism”.

2. At the 3rd annual European Students for Liberty Conference, at Humboldt University in Berlin 14–16 March 2014, Professor Gissurarson gives a lecture on the foreign factors in the 2008 collapse of the Icelandic banks, the government responses to it and the lessons other European nations can draw from them. His lecture is scheduled at 13.40–14.15 Saturday 15 March. Many well-known writers, scholars and commentators on current affairs talk at the conference, including Swedish historian Johan Norberg, Dr. Tom Palmer from the Atlas Foundation and Dr. Daniel Mitchell from the Cato Institute, both in Washington DC, the US, Professor Kewin Dowd from England, Dr. Karen Horn, a former business editor at Frankfurter Allgemeine Zeitung, who lectures at Humboldt University, Professor Charles Blankart, Humboldt University, Professor Ilya Somin, George Mason University, Virginia, the US, Dr. Alberto Mingardi, Bruno Leoni Institute, Italy, and Matthew Sinclair, Executive Director of the British Taxpayers’ Union. Professor Gissurarson’s lecture forms a part of the joint RNH-AECR research project on “Europe, Iceland, and the Future of Capitalism”.

3. At a meeting of the newly established political association, Framsokn, in the Faroe Islands, 22 March 2014 at 14.00 in the cultural house Østrøm, Professor Gissurarson gives a talk on “The Problems and Opportunities of Small Nations”. The Party’s leader is Poul Michelsen, Mayor of Thorshavn in 1981–92. At the meeting, another keynote speaker is the musician and singer Hogni Reistrup, who recently published a book on the emigration from the Faroe Islands and how to turn it around. Professor Gissurarson’s lecture forms a part of the joint RNH-AECR research project on “Europe, Iceland, and the Future of Capitalism”.

4. At the annual conference of APEE, the Association of Private Enterprise Education, 13–15 April in Las Vegas, Nevada, the US, Professor Gissurarson reads a paper on explanations of the 2008 Icelandic bank collapse at a seminar scheduled for Monday 14 April at 2.55 pm, with Anna Sachko Gandolfi in the chair. He argues against two common explanations of the bank collapse. One was that it was the failure of David Oddsson’s “neo-liberal” experiment in Iceland. Two facts are relevant here. First, the credit expansion abroad of the banks only began seriously in 2004, the same year Oddsson stepped down as Prime Minister. In the second place, and more importantly, the same regulatory and legal framework applied to the financial market in Iceland as in all other member states of the EEA, European Economic Area, including all the EU countries. The second explanation is that Icelandic bankers were less experienced and more reckless than their colleagues elsewhere. Against this, Professor Gissurarson submits that this only moves the explicandum—that which has to be explained—one square: Why did the inexperienced Icelanders receive all the credit from all the experienced bankers abroad? In the second place, many banks in other countries—UPS, RBS, Danske Bank, etc.—were close to collapse, in the United Kingdom, Switzerland and Denmark. What saved them was a government bail-out, which was, at least in the cases of Switzerland and Denmark, made possible by currency swaps agreements with the US Federal Reserve Board, refused to Iceland. Professor Gissurarson has spoken before at the annual conferences of the APEE and published papers in its Journal of Private Enterprise. His lecture forms a part of the joint RNH-AECR research project on “Europe, Iceland, and the Future of Capitalism”.

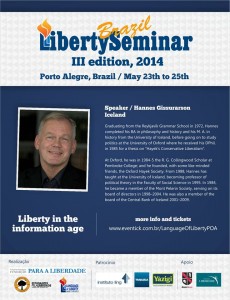

5–6. Professor Gissurarson gives two talks at conferences organised by Estudantes pela Liberdade, the Brazilian division of Students for Liberty, and supported by Friedrich Naumann Stiftung, in Porto Alegre 24–25 May and in Curitiba 30–31 May. His lecture in Porto Alegre is at IEGE (Instituto de Estudos em Gestão Empresarial), Praça Japão, 13, 14 o’clock Sunday 25 May. His lecture in Curitiba is at Universidade Positivo, Rua Prof. Pedro Viriato Parigot de Souza, 5300, 16.45 o’clock Saturday 31 May. His topic is on the “Internet as an Ally of Liberty”. Orwell’s apprehension that new information technology might be abused by Big Brother has only partly come true. The public can also use technology to evade or escape Big Brother, whether he presents himself as a private company trying to impose monopoly on consumers or as a government agency with a compulsion to monitor and regulate ordinary people. Moreover, the Internet is an immense pool of information. The websites of Atlas Network, Cato Institute, Heritage Foundation, Liberty Fund, AEI (American Enterprise Institute), Hoover Institution, Institute for Humane Studies, Institute of Economic Affairs, Adam Smith Institute and other free market think tanks provide a lot of useful intellectual ammunition for lovers of liberty. Again, data banks like the Index of Economic Freedom, Angus Maddison’s data on income and economic growth over centuries and even millennia, the economic research team at St. Louis Federal Reserve Bank, Eurostat, OECD, the World Bank og the International Monetary Fund are sources of much useful information. In his talks, Professor Gissurarson shows some revealing graphs drawn from those sources. His two talks in Brazil form a part of the joint project by RNH and AECR on “Europe, Iceland and the Future of Capitalism”.

5–6. Professor Gissurarson gives two talks at conferences organised by Estudantes pela Liberdade, the Brazilian division of Students for Liberty, and supported by Friedrich Naumann Stiftung, in Porto Alegre 24–25 May and in Curitiba 30–31 May. His lecture in Porto Alegre is at IEGE (Instituto de Estudos em Gestão Empresarial), Praça Japão, 13, 14 o’clock Sunday 25 May. His lecture in Curitiba is at Universidade Positivo, Rua Prof. Pedro Viriato Parigot de Souza, 5300, 16.45 o’clock Saturday 31 May. His topic is on the “Internet as an Ally of Liberty”. Orwell’s apprehension that new information technology might be abused by Big Brother has only partly come true. The public can also use technology to evade or escape Big Brother, whether he presents himself as a private company trying to impose monopoly on consumers or as a government agency with a compulsion to monitor and regulate ordinary people. Moreover, the Internet is an immense pool of information. The websites of Atlas Network, Cato Institute, Heritage Foundation, Liberty Fund, AEI (American Enterprise Institute), Hoover Institution, Institute for Humane Studies, Institute of Economic Affairs, Adam Smith Institute and other free market think tanks provide a lot of useful intellectual ammunition for lovers of liberty. Again, data banks like the Index of Economic Freedom, Angus Maddison’s data on income and economic growth over centuries and even millennia, the economic research team at St. Louis Federal Reserve Bank, Eurostat, OECD, the World Bank og the International Monetary Fund are sources of much useful information. In his talks, Professor Gissurarson shows some revealing graphs drawn from those sources. His two talks in Brazil form a part of the joint project by RNH and AECR on “Europe, Iceland and the Future of Capitalism”.

7. At the 2014 Nordic conference on research on men and masculinities in Reykjavik 4–6 June, sponsored by the Icelandic Ministry of Welfare and the Nordic Council of Ministers, Professor Gissurarson reads a paper titled “The Subjection of Men?” The reference is to the book by John Stuart Mill on The Subjection of Women, which has twice been published in Iceland. The paper is delivered at a seminar 9–11 in the morning of 6 June in Natural Sciences House Askja, Room 130. In his paper, Professor Gissurarson recognises that dominant ideas of masculinity and femininity may direct most people into certain channels in terms of lifestyles and professions, even if it is implausible to label these ideas coercive. When however important comparative data on the two sexes are analysed, on life expectancy, suicide rates, death rates from accidents, alcoholism, drug abuse, crime rates, prison population and sex reassignment surgeries, the demands of masculinity seem to be more difficult and to constrain individual choices much more than the demands of femininity. Women seem to be much more content and happier with life than men. Even if men have higher incomes on average, it should not matter much to those who believe that money is not the key to happiness. Often, also, the wage disparity can be explained by voluntary division of labour within a marriage.

8. At a conference organised by the Platform for European Memory and Conscience and by the Konrad Adenauer Stiftung in Prague 12–13 June 2014, the Prize of the Platform will be given to Mustafa Dzhemilev, the leader of the Crimean Tatars in their struggle to regain their homes in the Crimean Peninsula wherefrom they were forcibly evicted at the end of the 2nd World War. RNH is a member of the Platform, and Professor Gissurarson attends the ceremony as well as the conference which takes place in the Senate in the Czech Parliamentary Building, on “Legacy of Totalitarianism Today”. He is chairing one of the panels. Other participants in the conference include Professor Stéphane Courtois, the editor of the Black Book of Communism, MPE Vytautas Landsbergis, former Lithuanian President, Estonian historian and MPE Tunne Kelam, Latvian Film Director Edvīns Šnore and prize-winning Finnish-Estonian author Sofi Oksanen. Professor Gissurarson’s attendance at the Prague conference forms a part of the joint project by RNH and AECR on “Europe of the Victims”.

9. Professor Gissurarson attends a workshop organised by the Platform for European Memory and Conscience and by the Konrad Adenauer Stiftung in Prague 29 July 2014 on how to ensure justice for victims of communism, many of whom are still alive, as are indeed some of their persecutors. His attendance at the Prague workshop forms a part of the joint project by RNH and AECR on “Europe of the Victims”.

10. At the annual conference of NOPSA, the Nordic Political Science Association, in Gothenburg in Sweden 12–15 August 2014, Professor Gissurarson reads three papers. One of them is in a seminar on “International Courts and Domestic Politics”, chaired by Johan Karlsson Schaffer and scheduled Tuesday 12 August at 13.30–14.30. Professor Gissurarson discusses the Icesave dispute between Iceland on the one hand and the British and Dutch governments on the other hand, the position taken by the Nordic countries and the IMF, the International Monetary Fund, the attempts to reach an agreement, the decision by the EFTA court and the impact of the dispute and its resolution on Icelandic politics. The discussant is Dr. Matthew Saul, Postdoctoral Fellow in the Department of Public and International Law at the University of Oslo.

10. At the annual conference of NOPSA, the Nordic Political Science Association, in Gothenburg in Sweden 12–15 August 2014, Professor Gissurarson reads three papers. One of them is in a seminar on “International Courts and Domestic Politics”, chaired by Johan Karlsson Schaffer and scheduled Tuesday 12 August at 13.30–14.30. Professor Gissurarson discusses the Icesave dispute between Iceland on the one hand and the British and Dutch governments on the other hand, the position taken by the Nordic countries and the IMF, the International Monetary Fund, the attempts to reach an agreement, the decision by the EFTA court and the impact of the dispute and its resolution on Icelandic politics. The discussant is Dr. Matthew Saul, Postdoctoral Fellow in the Department of Public and International Law at the University of Oslo.

11. The second paper is in a seminar on “International Political Theory”, chaired by Göran Duus-Otterström and scheduled Thursday 14 August at 8.45–9.45. The paper is titled “Why Was Iceland Left Out in the Cold?” Professor Gissurarson describes how small nations have always had to accept interference from bigger nations, sometimes as allies and sometimes as aggressors. In the 20th Century, Iceland had successfully allied itself with the UK and the US. However, in the international financial crisis in the autumn of 2008, Iceland found itself suddenly without allies. The US Federal Reserve Board had made currency swap deals with the central banks of Sweden, Norway and Denmark, but refused the Icelandic central bank such a deal. The British government had refused to include two British-based banks owned by Icelanders in its rescue package. In fact, it had invoked its anti-terrorism law against one of the major Icelandic banks, and for a while also against the Icelandic central bank. The discussant is Dr. Aaron Maltais, Postdoctoral Fellow at the Department of Political Science at Stockholm University.

12. The third paper is in a seminar on “The Nordic Welfare Model in Transition”, chaired by Anders Lindbom and scheduled Thursday 14 August at 13.30–15.00. It is titled “The Icelandic Welfare State: Nordic or Anglo-Saxon?” There, Professor Gissurarson discusses the economic reforms of 1991–2004 and their impact on poverty, income distribution and social exclusion. He argues that during that period Iceland did not abandon the Nordic model for the Anglo-Saxon one, but rather that Iceland implemented its own model. Poverty and social exclusion had been less in Iceland than in most other OECD countries. Living standards of all income groups had however worsened after the 2008 bank collapse, especially though those of the highest-income group. The discussant is Stephan Köppe, Research Fellow at the University of Dundee. Professor Gissurarson’s three papers in Gothenburg form a part of the joint RNH-AECR research project “Europe, Iceland and the Future of Capitalism”.

12. The third paper is in a seminar on “The Nordic Welfare Model in Transition”, chaired by Anders Lindbom and scheduled Thursday 14 August at 13.30–15.00. It is titled “The Icelandic Welfare State: Nordic or Anglo-Saxon?” There, Professor Gissurarson discusses the economic reforms of 1991–2004 and their impact on poverty, income distribution and social exclusion. He argues that during that period Iceland did not abandon the Nordic model for the Anglo-Saxon one, but rather that Iceland implemented its own model. Poverty and social exclusion had been less in Iceland than in most other OECD countries. Living standards of all income groups had however worsened after the 2008 bank collapse, especially though those of the highest-income group. The discussant is Stephan Köppe, Research Fellow at the University of Dundee. Professor Gissurarson’s three papers in Gothenburg form a part of the joint RNH-AECR research project “Europe, Iceland and the Future of Capitalism”.

13. At the 28th Congress of Nordic Historians in Joensuu in Finland 14–17 August, Professor Gissurarson gives a lecture at a special seminar on the main theme of the conference, “Crossovers—Borders and Encounters in the Nordic Space”. The seminar is held 8–11 Saturday 16 August in Metria House at Joensuu University, and chaired by Finnish historian Jouko Nurmiainen. The title of the lecture is “Two Germans in pre-war Iceland, and their later strange encounter”. It is about the extraordinary stories of two Germans who both lived in Iceland immediately before the Second World War. One was a German Nazi, Dr. Bruno Kress, who taught German and conducted research on Icelandic grammar for Ahnenerbe, the research institute of Heinrich Himmler’s SS. The other German was a Jewish refugee, Henny Goldstein, who settled in Iceland with her son and her mother. One of her two brothers also managed to escape to Iceland before the War, but the other one perished in a research experiment on Jewish skulls and bones, organised by Ahnenerbe at the notorious Natzweiler concentration camp close to Strasbourg. When the British occupied Iceland in the spring of 1940, they interned Dr. Kress on the Isle of Man, until he was released to Germany in a prison exchange programme. Henny Goldstein however married an Icelander and became an Icelandic citizen. In the spring of 1958, Dr. Kress and Henny Goldstein met again in Iceland at the sixtieth birthday party of Brynjolfur Bjarnason, a prominent Icelandic communist. By then, Dr. Kress had become a communist and the director of the Nordic Institute at Greifswald University, whereas Henny Goldstein’s Icelandic husband was a long-time friend and supporter of Brynjolfur Bjarnason. There was an incident at the party, as Henny Goldstein protested against the presence of the man she had known as a Nazi in Iceland before the War; later the incident was discussed in newspaper articles and in correspondence between Dr. Kress and Einar Olgeirsson, the leader of Iceland’s Socialist Party (dominated by old communists). Other Icelandic lecturers at the meeting include Professors Anna Agnarsdottir and Gudmundur Jonsson, Sverrir Jakobsson, Olafur Rastrick, Margret Gunnarsdottir, Ragnheidur Kristjansdottir and Sumarlidi Isleifsson. Professor Gissurarson’s lecture forms a part of the joint RNH-AECR research project on “Europe of the Victims”.

14. Professor Gissurarson attends the general meeting of the international community of liberal (in the classical sense) scholars, Mont Pelerin Society, in Hong Kong 31 August–5 September. He has been a member of the MPS since 1984 and served on its Board of Directors in 1998–2004, organising a regional meeting in Iceland in 2005.

15. At a conference on English-Austrian economist and Nobel Prize Winner Friedrich A. Hayek and his ideas held by the Economic Freedom Institute at Manhattanville College, Purchase, New York on the weekend of 10–12 October, Professor Gissurarson gives a lecture on “Spontaneous Evolution: Three Icelandic Examples”. One such example was the development, soon after Iceland’s settlement in 874–930, of grazing rights in the Icelandic mountains, attached to individual farms, in order to prevent over-grazing. The second example is how the problem of an ever-depreciating local currency was solved by in effect developing a new currency, the indexed krona, one of the hardest currencies available, even if limited in scope. The third example is the development of a system of individual transferable quotas in the Icelandic fisheries in order to prevent over-fishing. This is in effect a system of privately held partial use or harvesting rights to the fertile fishing grounds in the Icelandic waters, initially assigned on the basis of catch history. Professor Gissurarson contrasts the spontaneous evolution of rules and institutions to constructivism, which might for example in the case of the quotas have required their government auction. His paper forms a part of the joint RNH-AECR research project “Europe, Iceland and the Future of Capitalism”.

16. At a regional meeting of the European Students for Liberty in Bergen, Norway, Saturday 18 October Professor Gissurarson provides a critique of the ideas of French economist Thomas Piketty who seems to be replacing American philosopher John Rawls as the intellectual prophet of the left. The difference is that Rawls was concerned with the poor, wanting to maximise their possible income, whereas Piketty is concerned with the rich, demanding confiscatory taxes on them. Professor Gissurarson discusses the problems of trying to measure income equality, not only by calculating Gini coefficients, but also by the method employed by Piketty which is to concentrate on the share of the 1% or 10% top income groups in total income. This share can be affected by external factors like the number of graduate students or of pensioners (an increase in the number of these groups will increase the share of the top income group in the total income of one year, while it does not mean that income distribution between groups has become more unequal, but rather that income distribution within the lives of individuals has become more unequal). It is also not certain that the rate of growth of capital will surpass economic growth, r > g, as Piketty holds. One only needs to read Balzac’s novels, so often quoted by Piketty, to see how fragile and perishable wealth can be. Professor Gissurarson’s paper forms a part of the joint RNH-AECR research project “Europe, Iceland and the Future of Capitalism”.

17. At the annual “Mirror of the Nation” at the University of Iceland, where social scientists present their findings, held this year on 31 October, Professor Gissurarson reads a paper on the view taken by the British Labour government on the Icelanders before the bank collapse, not least that of Mr. Alistair Darling, the Chancellor of the Exchequer, and what may have caused this view and which impact it may have had. He analyses the account of Icelandic bankers and politicans in Darling’s 2011 book, Back from the Brink, and corrects several errors to be found there. Professor Gissurarson’s paper forms a part of the joint RNH-AECR research project “Europe, Iceland and the Future of Capitalism”.

18. At the regional conference of European Students for Liberty in Reykjavik 15 November Professor Gissurarson gives a talk on the battle of ideas in the West. Professor Gissurarson’s paper forms a part of the joint RNH-AECR research project “Europe, Iceland and the Future of Capitalism”.

19. At a meeting held by the IEA, Institute of Economic Affairs, in London 27 November 2014 Professor Gissurarson gives a lecture titled: “Why Was Iceland Left Out in the Cold? And Kept There?” On this occasion, he describes the liberal economic reforms in Iceland in 1991–2004, the development from market capitalism to crony capitalism in 2004–8, the relations between Iceland and the UK before the Icelandic bank collapse on 7 October 2008, the closure the same day by British authorities of the London branch of Landsbanki, and the two Icelandic-owned British banks, Heritable and KSF, Kaupthing, Singer & Friedlander, the use by the UK government on the next day, 8 October 2008, of the anti-terrorism law against Landsbanki, the Central Bank of Iceland and the Icelandic Financial Authority and its consequences for the Icelandic economy, and the subsequent dispute in 2008–13 between the UK and Iceland on the liability for the Landsbanki Icesave accounts, leading to three failed deals and two national referenda in Iceland and the final judgement of the EFTA Court in Luxembourg, clearing Iceland of all charges. Professor Gissurarson’s paper forms a part of the joint RNH-AECR research project “Europe, Iceland and the Future of Capitalism”.

Gissurarson Slides in Berlin 14 March 2014